The Oil & Gas Financial Due Diligence Checklist

Decades of energy M&A experience, all compiled into the ultimate checklist to guide your next transaction.

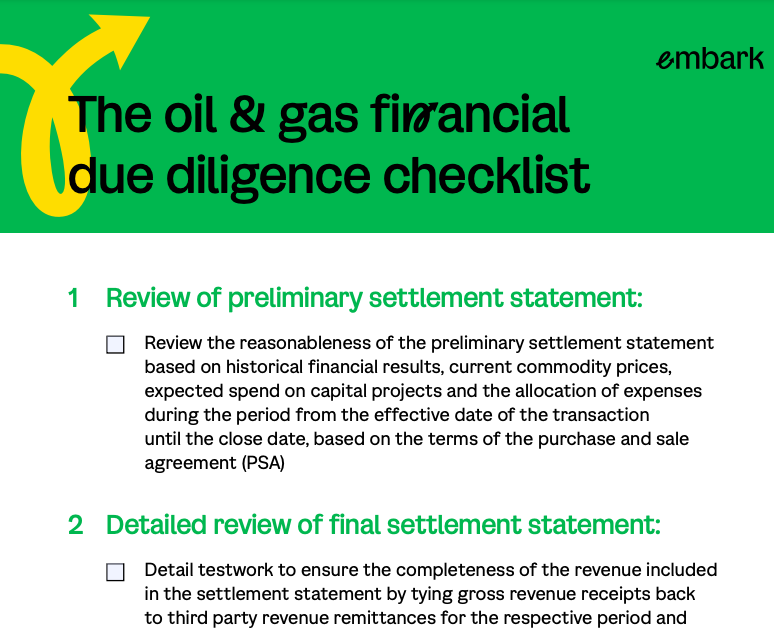

- Review of preliminary settlement statements

- Detailed review of final settlement statement

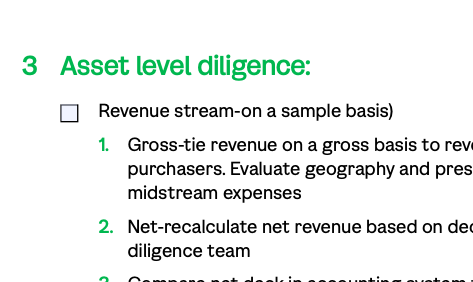

- Asset-level diligence

- Limited scope corporate financial due diligence

Download the checklist

Financial due diligence tips & insights from energy industry veterans

Embark's go-to checklist will guide you through the often murky M&A process in oil and gas, focusing on settlement statements, asset diligence, and corporate finance-level measures you can implement to ensure a successful, beneficial acquisition.

Trusted transaction support

Minimize transaction risk, maximize value and deal success. It’s what we do.

Pre-Transaction Diligence

Know what you're getting into. We dig deep to uncover potential risks, assess true value, and give you the information you need for confident decisions.

Acquisition Execution

Don't let a good deal fall apart at the seams. We’ll help manage the complexities of the transaction process, ensuring a smooth, efficient, and successful outcome.

Post-Transaction Support

Get the integration right the first time to ensure long-term success. Optimize operations, realize synergies, and drive growth post-transaction with Embark at your side.

Optimization and Growth

M&A is just the first step. After the final handshake, we help you get the absolute most out of your new entity. From tech stack to reporting, HR to ops, we'll ensure you’re primed for success.

Exit Strategies

Maximize your return. Whether it's an IPO, full sale, or strategic divestment, we help you develop an exit strategy that aligns with your goals and achieves the best possible outcome.