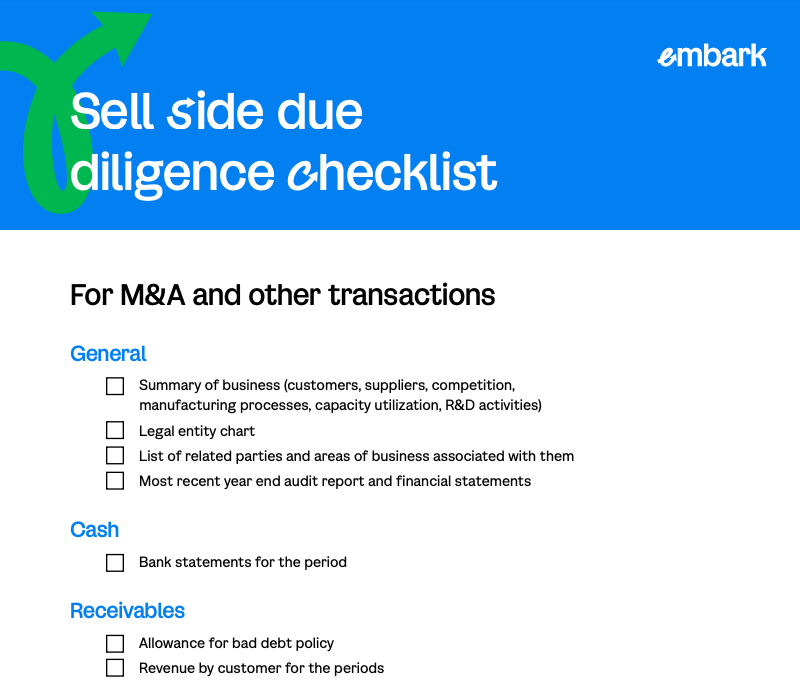

Sell-Side Due Diligence Report Checklist

A successful sell-side transaction hinges on your ability to put your best foot forward and shine a flattering but accurate light on your business.

Comprehensive but concise, walking you through key areas like:

- Executive summary

- Working capital

- Balance sheet

- Quality of earnings

- Supplemental analysis

Download the checklist

Sell-side due diligence tips

For any organization beginning the often laborious and stressful process of attracting a merger, acquisition, or even investment capital, we’re here to offer you a two-fer for the ages:

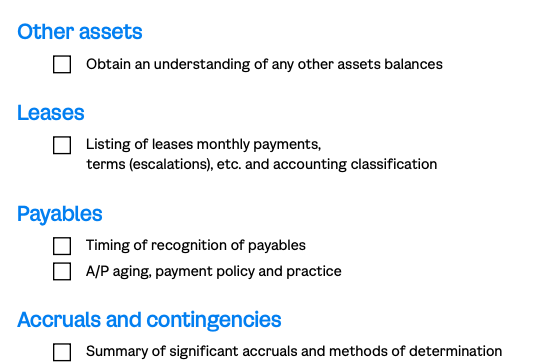

1. A detailed checklist to make certain you’re addressing every item critical to a seller’s due diligence process

2. Our sage guidance and best practices to use throughout the process

Trusted transaction support

Minimize transaction risk, maximize value and deal success. It’s what we do.

Pre-Transaction Diligence

Know what you're getting into. We dig deep to uncover potential risks, assess true value, and give you the information you need for confident decisions.

Acquisition Execution

Don't let a good deal fall apart at the seams. We’ll help manage the complexities of the transaction process, ensuring a smooth, efficient, and successful outcome.

Post-Transaction Support

Get the integration right the first time to ensure long-term success. Optimize operations, realize synergies, and drive growth post-transaction with Embark at your side.

Optimization and Growth

M&A is just the first step. After the final handshake, we help you get the absolute most out of your new entity. From tech stack to reporting, HR to ops, we'll ensure you’re primed for success.

Exit Strategies

Maximize your return. Whether it's an IPO, full sale, or strategic divestment, we help you develop an exit strategy that aligns with your goals and achieves the best possible outcome.